reit tax benefits uk

A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business carried on in the UK. That means that youre saving up to 740 annually on 10000 of REIT dividends.

Uk Reits A Summary Of The Regime Finance And Banking Uk

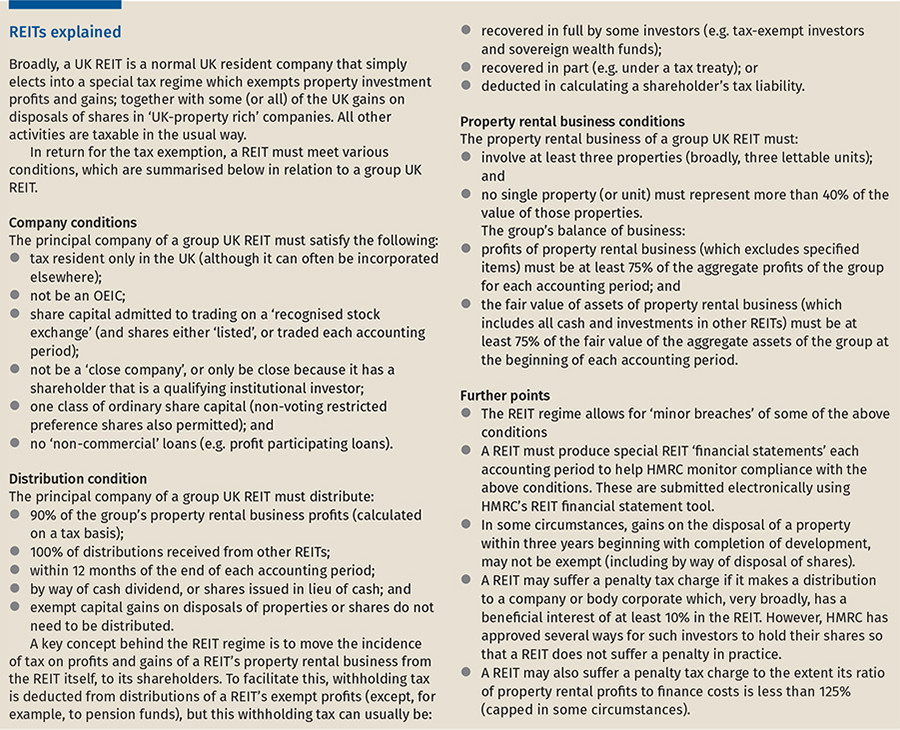

Changes to the REITs regime from 1 April 2022.

. Published 23 Mar 2022 1044. Corporation Tax is payable on its profits and gains from any other activities. Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on.

REITs are quoted companies or groups of companies that own and manage property whether that is commercial or residential with the aim of generating a rental income. REIT Tax Benefits No. Section 1250 gains are taxed at 25.

Why corporate governance matters. Find out how to deal online from 150 in a SIPP ISA or Dealing account. Investing in REITs via an ISA.

In such cases the company is considered as resident under provisions of the tax treaty. REITs are eligible ISA investments - so if you buy a REIT via an ISA neither you or the company pays any tax. That means theres no Income Tax Capital Gains Tax CGT or Corporation Tax for the company to pay while the value is held within the business accounts.

A real estate investment trust REIT is exempt from corporation tax on qualifying rental income and gains on sales of investment properties and shares in property investment companies used in its UK property rental business. Taxation Of Reits Ringing In The Changes A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen. Tax is only charged at the point when the money is then distributed to the REITs investors.

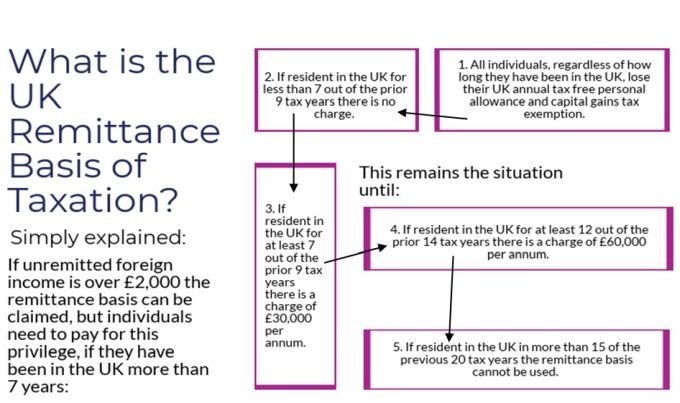

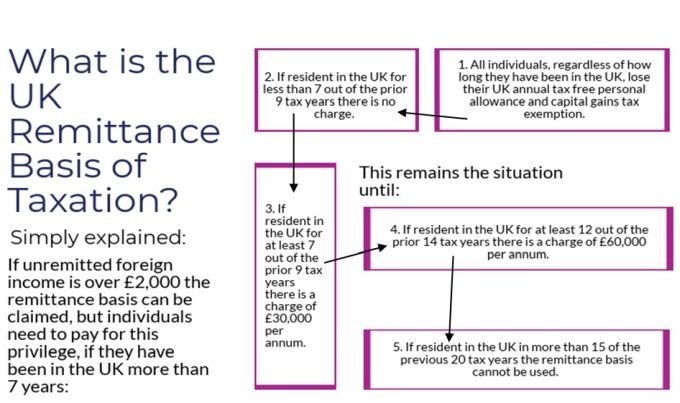

All UK residents receive an annual ISA allowance 20000 in 201819. Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of companies with a parent company that has elected to be a REIT under the UK tax legislation. A REIT or Real Estate Investment Trust is a specialist tax efficient investment vehicle built around real property assets and more specifically property rental activities.

The Government has made the REIT regime more attractive with the changes to the legislation in recent years. Originally established in the US in 1960 REITs were eventually introduced in the UK in 2007 with the hope of fueling speculation and real estate sector growth. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT.

UK REIT property income distributions are taxed as property income Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. This rate is prescribed by the DTT effective in the UK from 6 April 2010 and applicable for income paid onafter 6 April 2010 with no relief prior to that date. The following Corporation Tax guidance note Produced by Tolley provides comprehensive and up to date tax information covering.

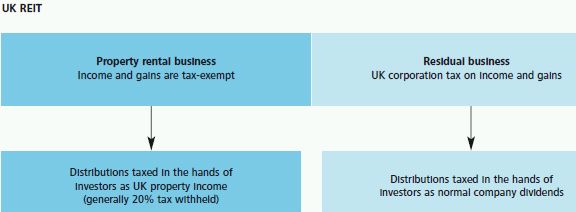

Property rental business Property rental business profits and gains are tax-exempt within the REIT itself. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. Cost basis has.

The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to its investors 100 of the property income distribution it receives from investing in another REIT. All profits and gains within a REIT are entirely tax-exempt. Heres the simple math.

The DTT with China does not apply to Hong Kong. Property investment becoming more accessible and desirable for all types of investors from pension funds who would be attracted by the regular cash flow to the man on the street who would be able to hold a liquid interest in large commercial property. Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to 296.

Please refer to the DTT. The election exempts a REIT from paying corporation tax on its qualifying property rental income and capital gains. Real estate investment trusts REITs Introduction to REITs.

Preferred shares in addition to five. Conditions which must be met by the REIT. Here are three big tax benefits you get when you invest in REITs.

Where in the world are the highest dividend yields. Though even that tax can be avoided. For example the France UK tax treaty allows REITs to benefit from its provisions even if they are expressly excluded under withholding tax rules.

Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status. The anticipated advantages of a UK REIT include the following. Reit tax benefits uk Saturday February 26 2022 Edit.

Qualified Dividends and Capital Gains Distributions are taxed at 0 for the 10 and 12 brackets and at 15 for the 22 24 and 32 brackets. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Relief may be restricted if the claimant is entitled to special tax benefits in the country of residence.

The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. Tax charges can arise if any of the conditions for qualifying for REIT status are breached although. Assuming highest tax bracket 37.

REITs are exempt from corporation tax on profits generated from rental income and the income from the sale of rental properties making them a tax-efficient investment choice. First the tax treaty can expressly mention the REITs as beneficiaries of the provisions of the tax treaty. Shares bought via an ISA are shielded from tax on both the dividends received and any capital gains on sale.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. Furthermore a REIT is able to benefit from a rebasing of underlying property assets when it acquires a company owning property investments meaning that the target.

Uk Reits A Summary Of The Regime Finance And Banking Uk

Nps Vs Ppf Which Is Better Personal Finance Plan Personal Finance Finance Plan Income Investing

Weekly Roundup 28th October 2015 7 Circles Stamp Duty Personal Finance Finance

Key Personal Taxes And Potential Advantages For Uk Non Doms Tax Uk

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

New Rules For Non Residents Holding Uk Real Estate Bdo

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Taxation Of Reits Ringing In The Changes

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Opportunity Zones Program Commercial Real Estate Investment Commercial Real Estate Modern City Aerial Photography

How To Invest In Reits In The Uk Raisin Uk

Dyman Real Estate How To Use Crowdfunding To Invest In Real Estate It S The Facebook Approach To Money Connect Real Estate Investing Crowdfunding Investing

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Difference Between Buying Your Own Home Or To Live In A Rent By Realtor Luqman Shaikh For More Info Details Call 4 Being A Landlord The Neighbourhood Rent

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Real Estate Investment Trusts Tax Adviser

Section 162 Executive Bonus Plan And It S Benefits Life Insurance Policy Permanent Life Insurance How To Plan

Maverick Has A Snazzy New Infographic That Walks You Through The 10 Basic Steps Of Buying Investment P Investment Property Investing Buying Investment Property

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen